CASH RULES, NEW STUDY FINDS

Angela Medley July 3, 2023

Angela Medley July 3, 2023

By Dr. Jessica Lautz on RISMEDIA

Since October 2022, the share of buyers purchasing their home without a mortgage has consistently been more than one-quarter of the market. The share is collected monthly in the REALTORS® Confidence Index and includes buyers who purchased primary homes, investors and vacation buyers.

These all-cash homebuyers are happily avoiding the higher mortgage interest rates, which touched 7% in the fall of 2022 before trending down to the current level of 6.28% as of this writing. Apart from the spring of 2022, one needs to look back to 2014 to see similar shares of all-cash buyers. In 2014, mortgage interest rates were in the low 4% range. In the months before the COVID-19 pandemic, the percentage of all-cash buyers hovered in the teens. While mortgage rates may be one component, they do not tell the whole story. So what happened, and who is paying all cash for homes?

One factor at play is the multiple-bid scenarios that took place throughout the COVID-19 pandemic. Homebuyers placed competitive offers on homes while inventory grew increasingly difficult to find. In March 2022, sellers received an average of 5.5 offers. Today, the average is 2.7 offers. Buyers wanted to find the perfect property before interest rates rose, so many were willing to offer all cash to sellers so their offer was not contingent on financing. Additionally, buyers migrated to more affordable locations in low-density areas, allowing them to purchase a home with all cash if they had housing equity from their past property. A National Association of REALTORS® (NAR) analysis of Federal Reserve Board of New York data shows that last year, the typical homeowner who had owned their home for a decade had more than $200,000 in housing equity to make a trade.

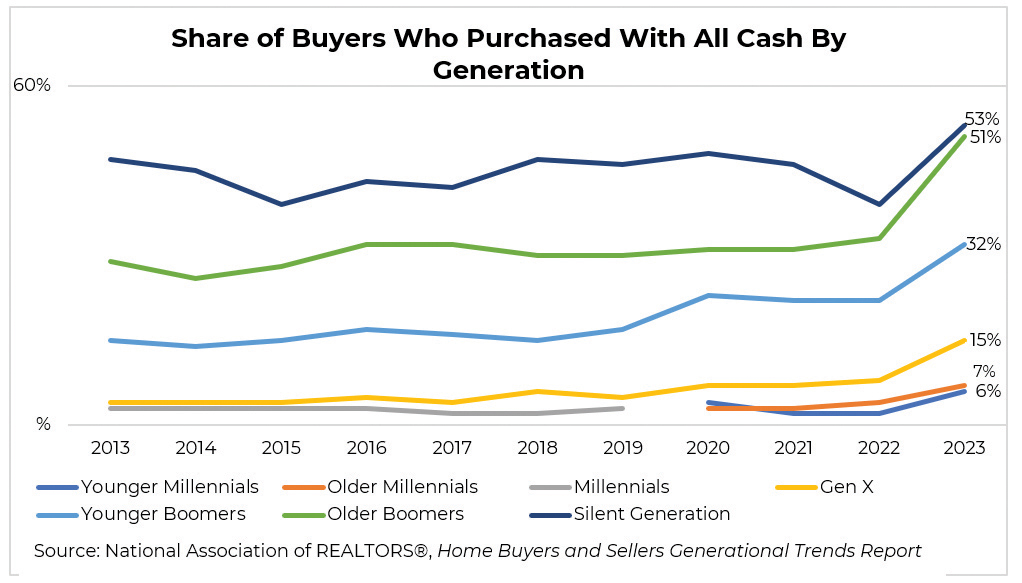

A deeper look at the buyers who are able to pay all cash tells the story of those who hold the cards in the housing market and those who do not. The largest share of homebuyers today are baby boomers. Among older baby boomers aged 68 to 76, more than half paid all cash for their recent home purchase. Among the Silent Generation (just 4% of recent buyers), 53% paid all cash for their home. The next question may be, well, doesn’t it stand to reason that seniors would pay all cash for their homes? The data shows us that this is not necessarily the case. Before last year, about one-third of older boomers paid for their home without a mortgage, and among the Silent Generation, the share never surpassed 48% in the historical data. Older buyers have significantly more housing equity, helping them make housing trades without needing a mortgage.

Indeed, the share of all-cash buyers has jumped for all generations. Among younger baby boomers, aged 58 to 67, the share purchasing without a mortgage made a one-year jump in 2022 from 22% to 32%. Even among Gen X buyers, aged 43 to 57, the share of all-cash buyers jumped from 8% to 15%. For both younger and older millennial buyers, it is still uncommon for them to pay all cash for a home purchase. Still, one may imagine those who made significant moves into more affordable locations such as “Zoom Towns” doing just that.

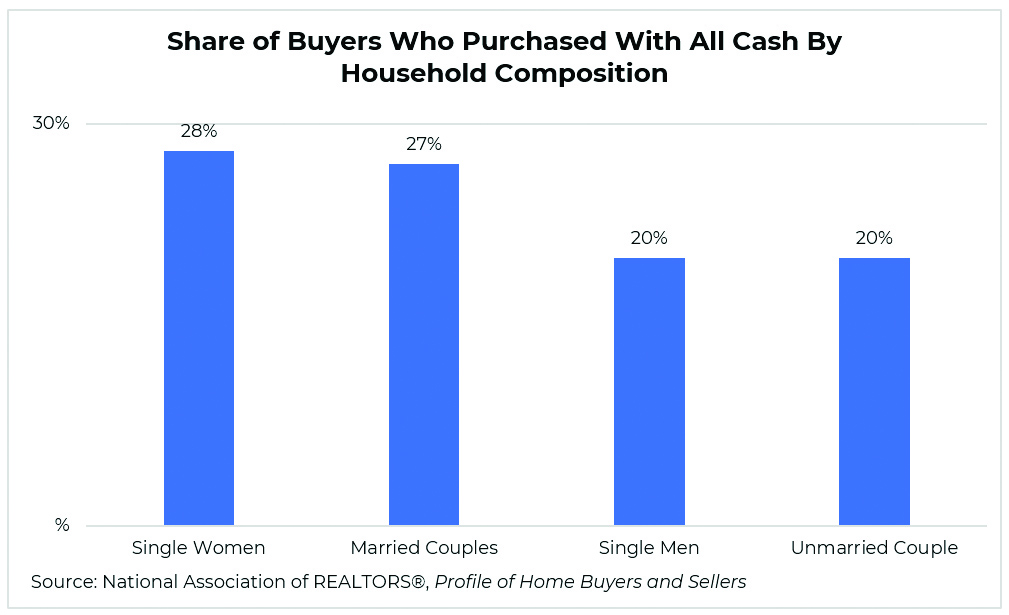

A surprising trend emerges when examining the share of all-cash buyers by household composition. Single-women buyers are the most likely buyer to purchase their home with all cash. These women may be widowed or divorced and have housing equity to make these trades; 28% purchased without a mortgage. For married couples, the share stands at 27%.

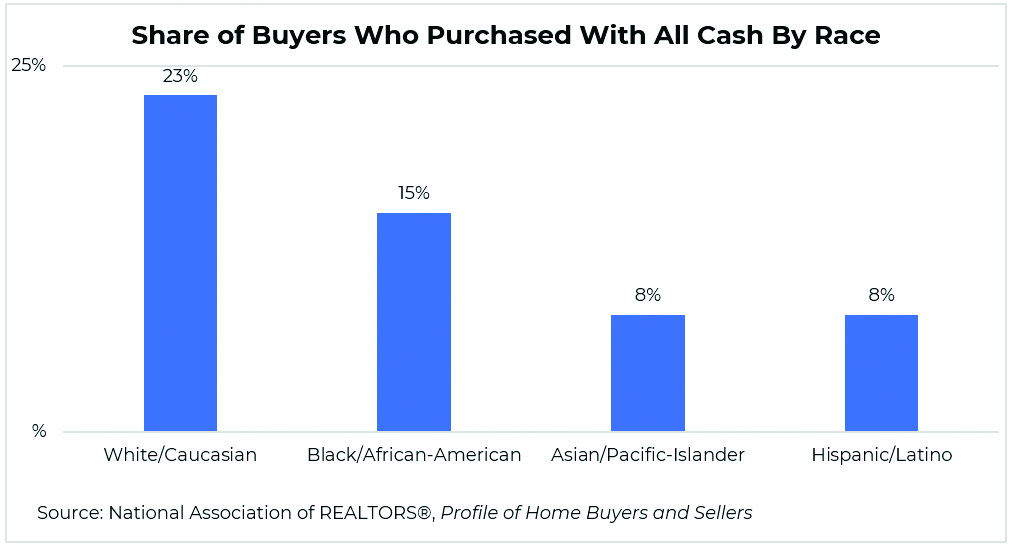

By race, 23% of white/Caucasian buyers could make their home purchase as an all-cash buyer. In comparison, among Black buyers, only 15% purchased as all-cash buyers. Notably, 49% of Black/African American buyers are first-time buyers compared to 24% of white buyers. Among Asian/Pacific Islander and Hispanic/Latino buyers, only 8% paid all cash for their recent purchase. Both groups have higher shares of first-time buyers who would need more housing equity to help them make a housing trade.

Clearly, the ability to purchase a home without a mortgage is significantly harder without housing equity to assist. Moving outside their current area is not an option for many buyers, as career choices and family ties may dictate their location. This can be discouraging for first-time buyers trying to enter a market alongside all-cash buyers. That’s especially true as multiple bids have resumed in some local areas. More housing inventory could improve affordability and provide relief for those who are having trouble competing with all-cash purchasers. As buyers navigate this market—both those flush with cash and those struggling to save—having experts by their side, like REALTORS®, members of NAR, and experienced mortgage brokers, is essential.

For more information, visit https://www.nar.realtor/.

Stay up to date on the latest real estate trends.

What You Should Be Doing Now

Let's do some good in our community together!